BRATTLEBORO — Suddenly, you are dead.

Nobody likes to think about dying. That is probably why more than half of us do so without a will.

Planning for death has been greatly complicated by our increasing reliance on the internet over the last two decades. Most of us today have intangible assets consisting of email; social media accounts such as Facebook; photographs; and links to bank and brokerage accounts that may not be readily accessible to our survivors.

As I will explain, recent legislation in Vermont has tried to address this concern.

* * *

To the dismay of the United States Postal Service, the volume of mail has declined considerably since the internet became such an important part of most of our lives.

In an effort to reduce costs, banks and brokerage firms have encouraged customers to “go green” and dispense with statements that are sent through the mail.

Executors and administrators of estates face new challenges finding assets and accessing the online accounts of those who have passed away.

Although 1099 forms that are sent in February provide clues, they are issued only when dividends and interest are more than $10. With interest rates at historic lows, that may never be the case with many bank accounts.

Dividend yields are also near historic lows, and some stocks do not pay any dividends.

As a result, more and more property is ending up with the unclaimed property divisions of state treasurers long after most estates have been closed.

There is still no simple way to search for unclaimed property in all 50 states. There is also no single database to enable executors, administrators, and guardians to find lapsed insurance policies.

* * *

You will do your family and whoever handles your estate a great service by getting organized.

• Write down on paper all of your assets, your online accounts, and your affiliated usernames and passwords.

• Tell a trusted family member or friend where to find that list.

• Since many websites also require you to answer security questions or change passwords periodically, it would also be a good idea to tell that trusted family member or friend the answers to the more commonly asked questions.

As an avid cyclist, I was moved by the account of Chanel Reynolds, a widow in Seattle whose husband was struck while riding his bike and died shortly thereafter, leaving his family completely unprepared.

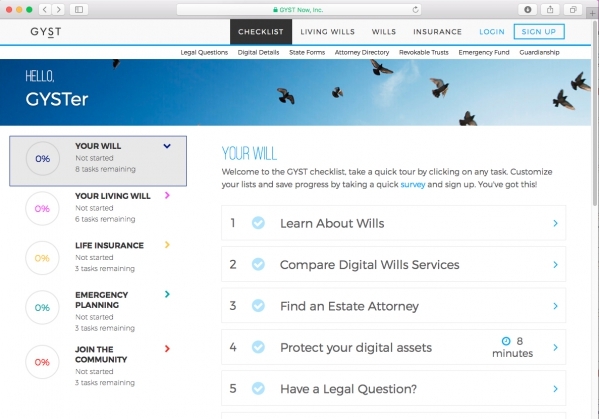

Chanel made it her mission never to let that happen to others. Her website is a good place to start getting organized. It may be found at gyst.com.

* * *

On May 1, Governor Phil Scott signed H.152, the Vermont Revised Uniform Fiduciary Access to Digital Assets Act. The law became effective on July 1.

Vermont thereby joined the vast majority of other states in adopting that uniform act, which provides executors, agents under powers of attorney, guardians, and other fiduciaries authority to manage digital assets in accordance with a user's estate plan, while protecting users' private communications from unwarranted disclosure.

Under the act, users can specify whether their digital assets should be destroyed, distributed to their heirs, or preserved.

Some custodians provide online tools that enable users to authorize other persons to access their digital assets.

In the absence of such instructions, users can provide for the disposition of their digital assets in their wills, trust agreements, and powers of attorney.

In light of the proliferation of digital assets, our office has begun addressing them in the estate planning documents that we draft for our clients.