BELLOWS FALLS — When evaluating any legislative action, I always step back and ask, “What is the core purpose of this bill?”

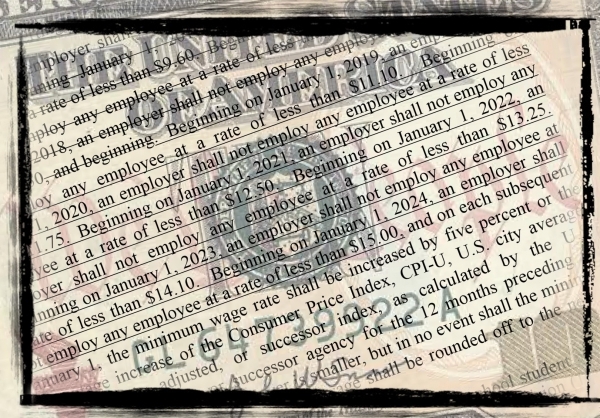

In examining the minimum wage increase bill, the purpose - from my perspective - is to ensure that Vermonters working a full-time job are not forced to toil in poverty but rather can experience the dignity of work that earns a livable wage.

I have always had a commitment to helping my working neighbors move ahead, and I thought that this legislation was a no-brainer ... until I looked further.

* * *

Upon closer inspection, one thing is clear: the system seems unfairly rigged against low-income individuals climbing out of poverty. Benefit programs offered by both the federal and state governments start to be removed at exactly the point when Vermonters need them most: when they are starting to make more money. This is referred to as the “benefits cliff,” and it truly is a precipitous decline.

Under the legislation for increasing the minimum wage, a single parent would be left over $750 worse than under the existing law, turning what should be an increase to an individual's bottom line into a de facto tax on the poor.

* * *

The bill makes meager attempts to ameliorate this issue by making slight adjustments to the child-care financial assistance program, to stabilize the income levels for which someone receives benefits. If everything works perfectly, the same family would net less than $200 extra per year.

This assumes, however, that Vermont will make the necessary investments to commit to this increase, which is by no means guaranteed. As an interesting side note, the child-care system currently relies on a 10-year-old market rate to calculate payments. The political will to make those rates more current has never existed. Why should we have faith that it will now?

A much more effective way of getting money to the same people whom we are trying to help is to have the courage to increase the Earned Income Tax Credit, which provides tax credits to working families, and to increase the market rate of the child-care subsidy to current levels.

I took this exact vote on an amendment before the Appropriations Committee on which I am a member. Unfortunately, this could not muster the votes to pass. This is especially disappointing, as this would have resulted in a substantial net increase in income to the entire minimum-wage workforce, without forcing them off the benefits cliff.

* * *

It was difficult for me to vote against such well-meaning legislation. Make no mistake; I believe in the core principles that are behind the push to increase the minimum wage to $15 per hour.

However, I feel that supporting this bill would have meant not only jeopardizing the very people that it is attempting to help, but would also amount to a tacit endorsement of this path as the best way to move people forward.

I am hopeful that in the future, the legislature will devote time to actually helping our Vermont neighbors instead of focusing on a sensationalist sound bite.

A minimum wage increase sounds nice, politically; allowing hard-working, low-income Vermonters to keep the money they earn sounds much, much better.