VERNON — The Vermont Department of Taxes recently informed town listers that they must add Vermont Yankee to the town's grand list for calendar year 2015.

This means that according to the state, Entergy, VY's parent company, must fork over $2 million, which will make its way into the state's education fund.

Though they ultimately billed the utility - and Entergy, for its part, is mulling its options over the matter - town officials are not happy, and they feel that the state agency has incorrectly put them in the middle.

The town wants to handle its relationships with the company delicately because of continued negotiations for future tax payments on a property whose valuation - and taxes assessed against that valuation - will only decline.

One town official says she has been told that $5 million already paid by Entergy to the state as part of an agreement to settle a series of lawsuits was earmarked for this purpose.

And with the state introducing such a large shift in town finances so late in the calendar year, the change might require adjustments to everyone else's tax bills.

Exempt while creating power

Until 2015, the nuclear power station was not included on the town's education property grand list. Because VY generated electricity until December 2014, it was instead subject to the state's electric energy generating tax.

As Vernon's Town Attorney Lawrence Slason explained at the Oct. 5 Selectboard meeting, “facilities which are subject to that electricity generating tax are exempt from the statewide education tax.”

“However, when those electricity generating facilities cease producing electricity, and there's no generating on which to levy a tax, then they become a part of the grand list of the taxing municipality,” Slason said.

Because VY has ceased electricity production, Slason said, the state Department of Taxes's position is “now they lose their exemption […] and Vernon should be sending them a tax bill, should be including them on the non-homestead grand list.”

By Slason's calculations, Entergy owes an additional $2 million to the state education fund.

“Vermont obviously has a significant interest,” Slason told the Selectboard, and Vernon is “the conduit to collect that tax.”

What about the $5 million?

A point of contention for town officials is the one-time $5 million payment that Entergy made to the Vermont Department of Taxes.

This payment is part of the settlement between Entergy Vermont Yankee, the Vermont Public Service Department, the Vermont Agency of Natural Resources, and the Vermont Department of Health, effective Dec. 23, 2013.

The agreement put to rest multiple actual or impending lawsuits in state and federal courts over the state's position that the plant could not legally operate with a certificate of public good.

“In our tax committee negotiations, we've all been trying to find whether that $5 million payment was going into the education fund or some other fund by the state, and this clarification just came down last week,” Vernon Tax Committee member Janet Rasmussen said.

“I asked two or three people about the [$5 million] payment, and they all have different answers,” Lister Carol Hammond said.

She said one person told her it was for litigation, another said it was “earmarked for the education fund,” and a third person told her it would be used for site restoration.

Hammond said she and her husband Bill, who is also a town lister, solicited state Rep. Mike Hebert, R-Vernon, for help in finding out what the $5 million was for, but Hebert was not able to get an answer for the Hammonds.

Bill Hammond said that Hebert was able to tell them that the tax department knew they were going to demand a tax payment from Entergy as far back as 2013, but he said this is the first time the Listers' Office received notice.

“I think we purposely were left in the dark,” Bill Hammond said.

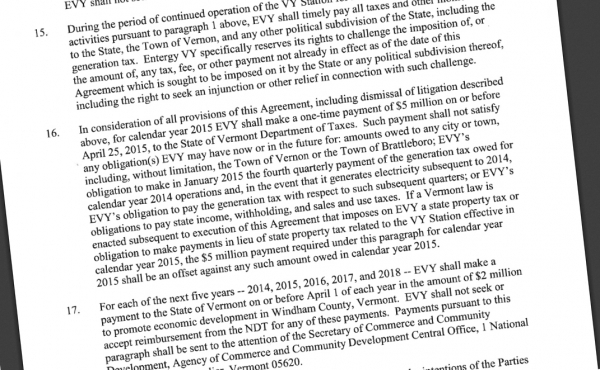

Paragraph 16

Slason told the Selectboard and the Listers the relevant portion of the Dec. 23, 2013 settlement agreement lies in paragraph 16: “Such payment shall not satisfy any obligation(s) [Entergy] may have now or in the future for: amounts owed to any city or town, including, without limitation, the Town of Vernon or the Town of Brattleboro.”

The Department of Taxes' position, Slason said, is “that sentence makes it clear that the $5 million is for something else,” but, he added, “I'm not sure what.”

When the agreement was first drawn up, Carol Hammond said, it was with the impression it was for a final payment to the education fund, but that document had apparently changed in some way between its inception and its final form.

“Well, it would be nice if it said that in paragraph 16,” Slason said.

Vernon in the middle

Carol Hammond told Slason and the Selectboard, “we weren't asked to” send the tax bill to Entergy. “We were told we had to,” she said. Otherwise, “if we left [Entergy] as an exempt property, the rest of the taxpayers of Vernon would make up the $2 million.”

“Which we obviously can't do,” Bill Hammond said.

“What we don't want is for Vernon to be in the middle of either the Public Service Board or the Agency of Natural Resources [...] and the Vermont Department of Taxes, and Entergy,” Slason said, adding, these are “the folks who carved out this agreement in 2013.”

“We don't want Vernon involved in that dispute, especially when you didn't have a seat at the table,” he said.

“It wasn't an agreement you helped draft,” Slason explained, and “Vernon shouldn't incur the time or additional legal expenses relating to the interpretation of a settlement agreement to which you're not a party.”

Bad timing

“This comes at a bad time,” Bill Hammond said, noting that “it's causing the town aggravation.”

Rasmussen said “at this point, we're negotiating next year's tax payment” with Entergy.

This tax issue is likely to spill over into the ongoing debate over the VY decommissioning trust fund.

Entergy has said it expects to use that fund for property tax payments, so any additional tax assessments could put a bigger dent in the fund - possibly delaying the completion of decommissioning.

State officials oppose use of the trust fund for tax payments.

Listers must adjust

“Vernon is being asked to levy and send a tax bill to Entergy, and include them on your non-residential grand list, and you'll have to take the steps to modify your grand list as a Selectboard,” Slason said.

The Listers will have to make adjustments to the grand list and get the Selectboard's approval and correct the grand list by Dec. 31, 2015, he noted.

“The law is clear - if the municipality exempts from taxation property which is supposed to be subject to the statewide education tax, the municipality must make up the difference by setting a tax rate sufficient to raise an amount of taxes to satisfy the differential,” Slason said. “So, that's the legal situation you find yourselves in.”

He said that the $2 million Entergy tax payment means an additional $2 million will go to the state to “satisfy Vernon's liability under the state education fund.”

Slason advised the listers to “approach it as if there were a substantial revision to a grand list property,” but that requires an adjustment to all other Vernon taxpayers' bills because the town has already received the first installment payments from taxpayers this calendar year.

By the time the town's second tax installment is due, “you figure out what the credit will be,” Slason said.

Your move, Vernon

Slason recommended Vernon send Entergy the tax bill. Then the town will have fulfilled its legal obligations under the statutes, and Entergy can make its decision.

He assured the town “Entergy is a big boy” and “is fully capable of responding in a manner that will protect its interest.”

Members of the Selectboard suggested proceeding with caution.

“Entergy knows this isn't the town's idea, right?” Board Chair Chris Howe asked the Hammonds.

“I explained that to them,” Bill Hammond said.

Board member Josh Unruh recommended Slason write a letter to Entergy, explaining their position, and to send that letter with the tax bill.

Board member Emily Vergobbe said she was concerned that the letter could suggest to Entergy officials that the town does not want to send the tax bill, and that suggestion might encourage the company to not pay it.

The board voted to instead authorize Slason to compose a letter expressing their position, and send it to the state tax commissioner and the Property and Valuation Review office, with a copy to Entergy.

Slason said he will incorporate language directly from the settlement agreement, saying that if Entergy disagrees with the Department of Taxes' position and relies upon the Dec. 23, 2013 agreement as the basis for its disagreement, then Entergy and the state should take primary responsibility for resolving that dispute.

He also advised the town to take no position, and his letter will state “we're following a directive from the Vermont Department of Taxes, and pursuant to that directive, we're forwarding a tax bill.”

Bill Hammond told Slason and the Board that he wants a letter to go to the state - “the Legislature, whoever” - telling those in a position of authority that Vernon is incurring expense and is in the middle of the state and Entergy.

He stressed to his colleagues, “the town has tried to get this $5 million info all along, including getting Mike Hebert to try to find out, and nobody would tell us anything.”

The tax bill is “their ball game, and not ours,” Bill Hammond said.

Contacted last week, Entergy Vermont Yankee Spokesman Marty Cohn said, “We've received the bill, and we're reviewing it.”

Cohn declined further comment on the matter.

Because half of the 2015 tax bill is due Nov. 1, Entergy is expected to make a decision in the next few weeks.