BRATTLEBORO — After several years of nickel-and-diming the municipal budget to reduce spending, members at this year's Representative Annual Town Meeting took a notably different direction.

In a marathon 13-hour session on March 23, members ended up with a $17.5 million budget for the 2020 financial year, including an increase in spending for human service organizations and for measures to address energy efficiency and climate change.

Meeting members also authorized an additional 1-percent local-option sales tax, championed as a new revenue stream for property-tax relief.

The Representative Town Meeting body approved new spending in amendments from the floor, including an amendment that increased sustainability funding tenfold.

After factoring the additional $153,295 in spending and the estimated $630,000 revenue from the new tax, the budget came to $17,503,773, with $14,801,497 needing to be raised from property taxes.

The new spending amounts to 1 percent of the total approved FY20 budget, which, according to Town Manager Peter Elwell, represents an overall reduction in the property-tax rate of 67 cents per $100 of valuation.

'No bigger issue': meeting approves aggressive funding toward sustainability

Combating climate change took center stage during debate when Town Meeting members overwhelmingly approved $100,000 toward energy efficiency or sustainability projects.

The Selectboard originally proposed $10,000.

This same article has appeared on the meeting warning for several years, at comparable spending levels, depending on the Town Energy Committee's specific needs.

In the past, the money funded a stipend for an energy coordinator, a position that is currently vacant. The $10,000 approved at last year's RATM has not been spent.

Abigail Mnookin (District 2) said of climate change, “There is no bigger issue, although there are many important ones.”

She made a motion to raise the sum to $40,000.

Meeting Member Orion Barber (District 1) suggested creating a sustainability fund using the unspent $10,000 from the previous year and adding Mnookin's $40,000 to it.

Elwell explained that Vermont law prohibited adding entities to the agenda that had not previously been warned, such as creating a new fund.

It was a bit of a bookkeeping issue, but Elwell told the body if it wanted to increase the amount going towards energy projects in town, they could authorize $50,000. The Selectboard would then use the previously authorized money towards the $50,000.

Mnookin accepted this friendly amendment.

State Rep. Mollie Burke, P-Brattleboro, noted that she has focused a lot of her legislative efforts on the House Transportation Committee and reversing climate change. She thanked the body for recommending the funding increase.

In Vermont, heating homes and driving motor vehicles are the two biggest contributors to the increasing levels of carbon emissions in the state, she added.

The body's conversation then turned to the Selectboard's vision of hiring a sustainability officer, who could focus on energy-related issues.

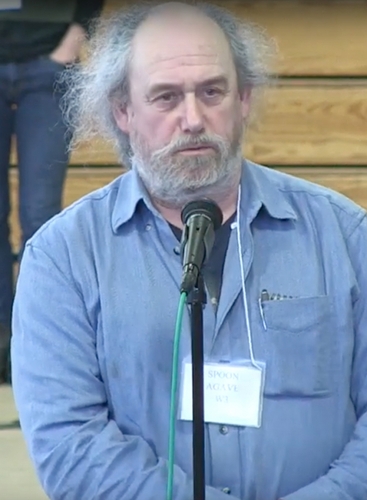

District 3 Meeting Member Spoon Agave said that “at the rate that things are deteriorating, you cannot go slowly” when trying to stop climate change, arguing that the town needs a sustainability officer immediately.

“You do not have another year to think about it,” he said.

Agave proposed a second amendment to raise the amount to $100,000.

It was a big move to be made from the floor of RATM, a move heralded by George Harvey (District 3).

“There is no item that is before this body that is more important,” Harvey said.

Meeting Member Christopher Chapman (District 1), a former Selectboard member, urged the body to remember the progress the town had already made regarding energy issues. He called the Agave Amendment “rash.”

In the end, members passed the amendment, 69–47, and the now-amended article passed overwhelmingly.

Enacting the 1 -percent local-option sales tax

After a two-hour discussion, members approved a 1-percent local-option sales tax by a 13-vote margin, 75–62.

Members speaking in favor of the tax said it would provide a new revenue stream to help the town's finances. Those who spoke against the tax worried it would hurt the town's economy by driving shoppers away.

Selectboard member Tim Wessel said the tax could provide an estimated $630,000 boost to the town's revenue, presumably to be used toward offsetting property taxes.

He said he worries that without more revenue streams and less of the budget relying on property taxes, Brattleboro would become a town of “the haves and the have nots.”

At a previous meeting, Selectboard Chair Kate O'Connor stated that 85 percent of the municipal budget is paid through property taxes.

“Eighty-five percent of the burden is too heavy,” Wessel told Town Meeting members. In Wessel's opinion, concerns that the additional tax will send most of the people driving to Keene, N.H., to shop are unfounded - that those who would care already make the short drive across the Connecticut River to the sales-tax-free state.

“We've lost them already,” he said.

Kathy Dowd (District 1) saw the tax as an opportunity to reinvest in the town and its schools.

“I don't want to be defined by what our neighboring states choose to do, I want us to blaze our own trail,” Dowd said.

Craig Miskovich (District 1) called the tax “inefficient, regressive, and imposed on locals.”

In his view, the tax would create more work for merchants, and 30 percent of the proceeds remain in the state coffers because the Department of Taxes administers the collection.

The tax would be regressive, he said, because it would tax consumption, which hits people in all income brackets regardless of their ability to pay. By contrast, he said, the property tax is progressive because those who can afford to buy and maintain an expensive home would pay more tax in proportion to the property's value.

Finally, said Miskovich, the majority of people who would pay the tax will be locals.

“We'll only be taxing ourselves,” he said.

Stanley “Pal” Borofsky (District 1), who has fought against the tax every time it has come before the body, compared the economic health of his family business, Sam's Outdoor Outfitters, to the other Sam's stores the family owns in North Swanzey, N.H., and in Hadley, Mass.

The Brattleboro store would be out of business if it weren't for the revenue of the other two stores, Borofsky asserted.

“I think you're driving business out of the community,” he said.

Harvey questioned the tax, saying while he'd end up paying more for goods, he doubted his landlady would reduce his rent to reflect any savings on her property-tax bill.

Town Attorney Bob Fisher said a scenario floated by HB Lozito (District 2) - a point-of-sale system where shoppers who could prove Brattleboro residency wouldn't pay the tax- would violate state law.

Daniel Quipp (District 2) noted that merchants could choose to charge less for their goods by 1 to 7 percent as well to reduce costs for people.

O'Connor, the executive director of the Brattleboro Area Chamber of Commerce, spoke in that capacity to quote figures from a 2010 study conducted by Art Woolf, associate professor of economics at the University of Vermont.

The study was funded by the Beverage Association of Vermont, Vermont Grocers' Association, Vermont Retail Association, and the Vermont Chamber of Commerce.

According to O'Connor, the Woolf study found that when Vermont first enacted its sales tax in 1969, per capita spending between the two states was “about equal.”

In the intervening years, however, per capita spending has changed. In 2007, said O'Connor, Vermonters spent approximately $11,000 on goods with a sales tax. New Hampshire residents, in comparison, spent approximately $18,000 per capita.

Guidance for human service resources?

Debate on what amount of money to award human service organizations and what process the town should follow circled for approximately three hours and - by a single-vote margin - boosted town funding for 26 human-service agencies.

After several proposed amendments, Meeting Members authorized a 15-percent increase - to $169,395 - to the funding allocated by the Human Services Committee to distribute as it saw fit to the organizations it had already reviewed in its recommendations for $147,300 in funding.

Every year, the committee evaluates applications from human-service organizations that serve Brattleboro residents. The committee then presents the organizations and the amount requested in one article as one sum.

From year to year, the organizations vary, as can their funding. This year's group of 26 service agencies included the AIDS Project of Southern Vermont, Big Brothers Big Sisters, Brattleboro Area Hospice, and Southeastern Vermont Community Action.

Two organizations that missed the committee's deadline this year had petitioned the Selectboard to be added to the meeting warning as separate articles, independent of the Human Services Committee scrutiny.

KidsPLAYce appeared as a separate article. The organization requested $4,000.

The Visiting Nurse Association/Hospice for Vermont and New Hampshire also missed the deadline and appeared as a separate funding article. This organization requested $12,000.

Such direct appeal to the Selectboard is a measure available to any community organization. Two familiar examples are the Brattleboro Development Credit Corporation and Southeastern Vermont Economic Development Strategies.

Franz Reichsman (District 2), a member of the RATM's Finance Committee, told the body that the Finance Committee wanted KidsPLAYce and VNA/Hospice to receive some funding in recognition of the service they provide to residents.

The committee also felt, however, that it didn't want to directly reward the two organizations for not following the town's procedure of making funding requests through the RTM Human Services committee, he said.

Reichsman explained that the Finance Committee therefore recommended that KidsPLAYce and Visiting Nurses both receive reductions of 20 percent: $3,200 for KidsPLAYce and $9,600 for VNA/Hospice.

Debate ensued.

And ensued some more.

And kept ensuing.

Saying that the body's earlier approval of the sales tax had him “feeling feisty,” Harvey made the first amendment to increase the allotted funding by 100 percent.

Other members suggested using all of the money raised by the new tax go to fund human services.

Several members asked if they or the Selectboard could - or should - provide guidance to the Human Services Committee about funding priorities.

Human Services Committee member Margaret Atkinson (District 2) thanked members for their “great out-of-the-box suggestions.” She added, however, that the committee undergoes a thorough process that involved balancing the organization's funding needs with the town's needs.

In general, the committee doesn't fully fund organizations' requests, she said.

Atkinson also posed a question to the members: If they wanted to make such big changes from the floor, did they even want a Human Services Committee?

Robin Morgan (District 2) said she respects the committee's work but if the choice came down to respecting its process or protecting vulnerable children, she would vote for the children.

Morgan then made a friendly amendment to fully fund all the requests made to the committee by the area service providers by increasing the amount to $181,300, or approximately 1 percent of the town's budget.

Prudence MacKinney (District 1) spoke against the amendment because she felt it defied the Human Services Committee's process.

“The problems are immense,” MacKinney said. “We could spend 10 percent of the town's budget and still have issues with opiates and poverty in this town.”

MacKinney said the body should focus on issues that the municipality could control.

Quipp said he understood his fellow members' arguments, but they assumed that 1 percent of the town's budget would be enough to combat the social issues Brattleboro residents face.

“They are life-or-death organizations,” he said, charging that meeting members were getting stuck on a committee's process.

Quipp, recently elected to the Selectboard, said that over the next year he wants to focus on actions to end these life-or-death situations, such as poverty.

Oscar Heller (District 3) proposed an amendment to increase the funding for the omnibus funding article by 15 percent, or $22,095.

The amendment eked by in a vote of 63–62.

Members passed the articles funding KidsPLAYce and Visiting Nurses as presented.

A change in priorities

The new spending authorizations appear to have less to do with a change in the pressures on the municipal budget and more to do with a change in the priorities of members.

Past Representative Annual Town Meetings have been marked by lengthy debates about how to keep spending down and property taxes as low as possible.

In 2010, meeting members argued extensively over moving to a pay-as-you-throw trash-disposal system. Many argued at the time that paying for garbage bags would prove a hardship for lower-income residents.

Once the system was approved, it was then overturned in a town-wide vote before being enacted in response to the state's Universal Recycling Law (Act 148).

Similar debates happened over bonding for the Police-Fire Facilities for several years before the vote passed. Again, it was concern over the multi-million dollar bond's effect on property taxes that fueled the opposition.

Partial funding for the Police-Fire Facilities Upgrade Project was initially authorized in 2012, but a series of events - which included a successful public referendum that overturned the municipal budget - put the project on hold. The town finally broke ground on the project in 2016.

Likewise, the 1-percent local-option sales tax had come before Town Meeting members a number of times over the past few years.

This year's Representative Town Meeting, however, took a different direction toward a focus on funding human-service organizations and fighting climate change.

The body itself also appeared more organized into interest groups promoting causes. Piled between the stack of copies of the 2018 Annual Town Report and school-budget information were position papers with titles like “Putting our money where our mouth is,” “Share our community to preserve our community,” and “A progressive vision & FY2020 Recommendations for Brattleboro Representative Town Meeting.”

But there were some limits.

Meeting members overwhelmingly defeated the final article, a non-binding measure, that outlined steps the town should take to combat climate change.

The measure would have recommended that the town require employees to turn down the heat in municipal buildings and wear long-johns and sweaters.

Daniel Jeffries (District 1) cautioned the body that the measure included items that would impinge on residents' freedoms.

The measure also asked the Selectboard to enact an ordinance requiring residents to take similar actions.