TOWNSHEND — My wife and I have been in Vermont since 1977. We filed our 1977 tax returns and paid Vermont tax on what was, at the time, income generated in New Hampshire.

We currently live in the same house, we use the same post office box, and our Social Security numbers are the same. The only thing that has changed in 39 years is that our road was given a name when E911 came in to being.

We started paying a professional to do our taxes, beginning in 2011 for the filing year 2010. This professional from Townshend has known us personally for many years and is required, as we understand it, to file returns electronically, not to mention comply with all legal statues and guidelines pertaining to his profession.

Those are the only changes in our personal information over all these years and in the method by which we file our returns. If we were not paying him, these tax returns would still be submitted on paper.

Last year, after having paid this licensed and reliable professional, the DOT sent us a letter demanding copies of 1099s and W-2s. Our preparer asked one agency representative why the tax department had requested this. He was pretty much told, “Because we can.”

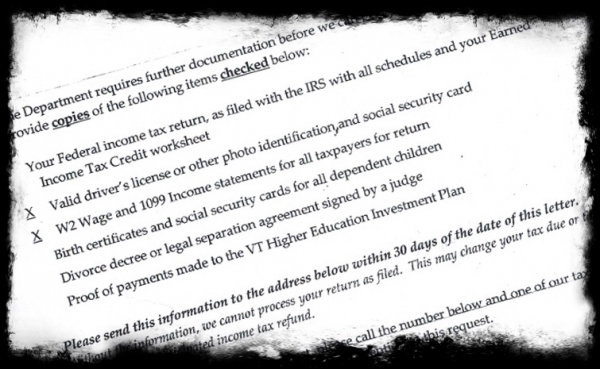

This year, I not only got the same request but the Department of Taxes also wanted a copy of my and my wife's respective driver's licenses and Social Security cards.

I do not recall having to submit that when I sent our first-quarter estimated payment in - money that the DOT seems to have no trouble accepting despite any lack of proof of identity on my part. I used the same post office box as a return address that is on my tax forms.

All the information that the state is requesting has been given on our returns, aside from the driver's license information. All the personal information on those forms is exactly as it has been for the last 39 years.

* * *

This situation brings up the following points:

What the Vermont Department of Taxes is essentially telling me: my tax professional is a thief who is attempting to steal from us.

If this is true, why is he licensed to do business in the state? Why on earth do I pay him? He is required by law to submit accurate and complete information - which he did, both this year and last.

The returns for 2015 were filed, electronically, in mid-to-late February, and it took until mid-May for the DOT to get this request to me? Seems this request could have come down a lot sooner. No wonder the department states on its website that refunds take eight to 10 weeks to process.

Like it or not, my time is actually worth something. When I have to spend my time copying and submitting information that is redundant, should I not be compensated?

By my calculations, the time spent on the phone with the tax department; the time spent finding, copying, and double checking the documents requested; and the cost of mailing those documents comes to $38.41. (Better than half my refund amount, I would add.) That cost would be much higher if I did not have a copier at home.

The state should be able to correlate the information my tax preparer/accountant submits with information from other sources. If the DOT is incapable of doing so, then:

1. Perhaps the state needs to spend time improving its data systems.

2. Or, the easy way: require documents be scanned and filed electronically along with the tax forms.

In all cases, it is the state Department of Taxes' job to double check the information, not mine. There is no excuse whatsoever for needing copies of W-2s - none.

* * *

I was told on the phone that the reason the DOT needed copies of our driver's licenses and Social Security cards was to prevent identity theft. I have no issue calling this demand a completely worthless and idiotic excuse.

If thieves want my $60 (or if one wanted to pay the state the outstanding amount of money I owed last year), more power to them. That is an awful lot of work to go to for a small amount of money or to pay someone else's tax bill.

On the other hand, the state has requested that I put into one envelope every piece - every piece - of information a thief would need to completely wipe us out. If that envelope were to fall into the wrong hands, we would be penniless in a matter of minutes.

All of our 1099s, except for one from the IRS, no less, contain only the last four digits of our Social Security numbers, so the full number is not accessible to an identity thief.

Quite frankly, I probably understand the security issues better than the DOT does.

As Vermont, and tax departments of other states, move toward systems to make life easier, they are entering a world where they will find it is impossible to prevent fraud. Furthermore, the DOT cannot promise that the package of documents will not end up in the hands of an employee who is happy to sell copies to the highest bidder.

Meanwhile, if something does happen, it will be next to impossible for me to prove it was the result of a lack of security on the state's part - and, of course, the DOT will deny that it could possibly be at fault.

* * *

Now, the simple solution to the DOT's issues with documents and need for proof of identity would be for us to wait a whole year: not pay our quarterly taxes, have income-producing entities not pay any withholding, and pay a nice sum at the end of every tax year.

That way, since we would submit a big check, the state would not have any doubts that we are who we say we are - no respectable thief would send in a check. But we'd be charged penalties and interest if we do so. That seems highly unfair.

The more complex solution, and the one that we intend to use from now until we die, is to have our tax preparer complete and submit our federal tax returns. I will complete the Vermont returns on paper and mail them in.

I have one absolute demand, and I am just crazy enough to go find a lawyer to press it.

I want to see, in writing, exactly what the Department of Taxes intends to do with the driver's license and Social Security card copies that the agency required.

I want to have a list of every hand they pass through, by name. I want to know what will be done with them. I want to know what offices they might move through.

Quite frankly, I believe I have that right since, as of April 30, 2016, at 9:42 a.m., the state has in its possession all the information needed to completely bankrupt us. No other entity, anywhere, including the federal government, has that data in hand in such a readily available format.

And finally, what makes the Department of Taxes' request very ironic?

The first thing that one sees when one goes to the department's website is a warning popping up about people stealing W-2 information.